Samanta Company has 20 million equity shares outstanding. The book value per share is 40

and the market price per share is 120. Samanta has two debenture issues outstanding. The

fi rst issue has a face value of 300 million, 12 percent coupon, and sells for 90 percent of

its face value. It will mature in 5 years. The second issue has a face value of 200 million,

14 percent coupon, and sells for 102 percent of its face value. It will mature in 6 years.

Samanta also has a bank loan of 200 million on which the interest rate is 15 percent.

a. What are Samanta’s capital structure weights on a book value basis and on a market

value basis ?

b. Which weights would you use? Why?

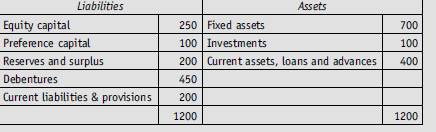

The latest balance sheet of Omega is given below:

• Omega’s target capital structure has 50 percent equity, 10 percent preference, and 40

percent debt

• Omega has ` 100 par, 10 percent coupon, annual payment, noncallable debentures with 8

years to maturity. These debentures are selling currently at ` 112.

• Omega has ` 100 par, 9 percent, annual dividend, preference shares with a residual maturity

of 5 years. The market price of these preference shares is ` 106.

• Omega’s equity stock is currently selling at ` 80 per share. Its last dividend was ` 2.80 and

the dividend per share is expected to grow at a rate of 10 percent in future.

• Omega’s equity beta is 1.1, the risk-free rate is 7 percent, and the market risk premium is

estimated to be 7 percent.

• Omega’s tax rate is 30 percent.

Required

(a) What sources of capital would you consider relevant for calculating the weighted average

cost of capital?

(b) What is Omega’s post-tax cost of debt?

(c) What is Omega’s cost of preference?

(d) What is Omega’s estimated cost of equity using the dividend discount model?

(e) What is Omega’s estimated cost of equity using the capital asset pricing model?

(f) What is Omega’s weighted average cost of capital? Use the capital asset pricing model to

estimate the cost of equity.