The accounting staff of CCB Enterprises has completed the financial statements for the 2017 calendar year. The statement of income for the current year and the comparative statements of financial position for 2017 and 2016 follow.

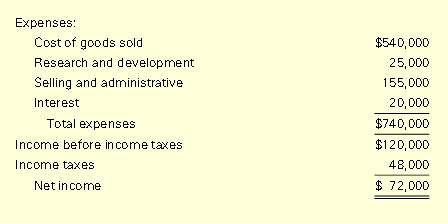

CCB Enterprises

Statement of Income

For the Year Ended December 31, 2017

(thousands omitted)

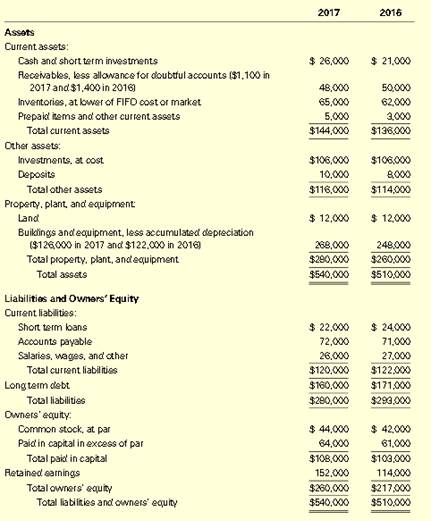

CCB Enterprises

Comparative Statements of Financial Position

December 31, 2017 and 2016

(thousands omitted)

Required

1. Calculate the following financial ratios for 2017 for CCB Enterprises:

a. Times interest earned

b. Return on total assets

c. Return on common stockholders’ equity

d. Debt-to-equity ratio (at December 31, 2017)

e. Current ratio (at December 31, 2017)

f. Quick (acid-test) ratio (at December 31, 2017)

g. Accounts receivable turnover ratio (Assume that all sales are on credit.)

h. Number of days’ sales in receivables

i. Inventory turnover ratio (Assume that all purchases are on credit.)

j. Number of days’ sales in inventory

k. Number of days in cash operating cycle

2. Prepare a few brief comments on the overall financial health of CCB Enterprises. For each comment, indicate any information that is not provided in the problem that you would need to fully evaluate the company’s financial health.