CASE

NINE DRAGONS PAPER*

NINE DRAGONS DENIES REPORT OF BANKRUPTCY

China’s Nine Dragons Paper (Holdings) Limited is denying media reports that it would declare bankruptcy at the end of 2008 and says its finances are fine, Bloomberg reports. The Guangzhou, China based Times Weekly reported on Dec. 25 that an unidentified Nine Dragons official said in an unidentified web posting that the company would declare bankruptcy because it couldn’t repay a loan worth $75 million. ‘‘Such articles have no basis in fact,’’ Nine Dragons said in a Hong Kong stock exchange filing on Dec. 29. ‘‘The company is not involved in any bankruptcy, liquidation, or winding up proceedings and the company’s financial situation is sound and stable. Operations are normal.’’ Nine Dragon’s profit for the six months ended June 30 fell 22 percent from the same period a year earlier. —Official Board Markets, 3 Jan 2009, p. 13

THE GLOBAL RECESSION

‘‘This time is really different. Large and small are all affected. In the past, the big waves would only wash away the sand and leave the rocks. Now the waves are so big, even some rocks are being washed away.’’ —Cheung Yan, co-founder and Chairwoman of Nine Dragons Paper1 Incorporated in Hong Kong in 1995, Nine Dragons Paper (Holdings) Limited, had become an international powerhouse in the paper industry. The company’s primary product was linerboard, with a product line including ![]() , testliner-board and white top linerboard in a portfolio of paperboard products used to manufacture consumer product packaging. The company had expanded rapidly and spent extensively. But by January 2009 the world economy was spiraling downward. Squeezed by market conditions and burdened by debt, Nine Dragons Paper (NDP), the largest paperboard manufacturer in Asia and second largest in the world, saw its share price drop to HK$ 2.33, 90% off its high and less than half of book value. As the economic crisis of 2007 bled into 2009, export-oriented industries suffered. Rumors had been buzzing since October that NDP was on the ropes. It was carrying so much debt that more than one analyst was asking, ‘‘Will they go bust?’’ Was the financial crisis of 2008 about to claim another victim, or had friction between the global economic crisis and the company’s debt ignited jittery nerves in the global markets? THE CHAIRLADY Cheung Yan, or Mrs. Cheung as she preferred, was the visionary force behind NDP’s success. Her empire had been built from trash—discarded cardboard cartons, to be precise. The cartons were collected in the U.S. and Europe, shipped to China, then pulped and re-manufactured into paperboard. NDP customers then used the paperboard to package goods that were shipped back to the U.S. and Europe where the cycle was repeated. ‘‘Wastepaper is a forest,’’ a former boss once told Mrs. Cheung. NDP had worked to perfect the harvesting of that forest. Born in 1957, Mrs. Cheung came from a modest family background yet through hard work, perseverance and savvy business strategy she built a company that was a dominant force in the industry. She had started as an accountant for a Chinese trading company in Hong Kong; after her employer failed, she started her own company to deal in scrap paper. In 1990 she moved to the U.S. to start another company, American Chung Nam Incorporated (ACN), to capture the waste paper stream there. ORIGINS It is the largest of scaly animals, and it has the following nine characteristics. Its head is like a camel’s, its horns like a deer’s, its eyes like a hare’s, its ears like a bull’s, its neck like an iguana’s, its belly like a frog’s, its scales like those of a carp, its paws like a tiger’s, and its claws like an eagle’s. It has nine times nine scales, it being the extreme of a lucky number. —www.ninedragonbaguazhang.com/ dragons.htm

, testliner-board and white top linerboard in a portfolio of paperboard products used to manufacture consumer product packaging. The company had expanded rapidly and spent extensively. But by January 2009 the world economy was spiraling downward. Squeezed by market conditions and burdened by debt, Nine Dragons Paper (NDP), the largest paperboard manufacturer in Asia and second largest in the world, saw its share price drop to HK$ 2.33, 90% off its high and less than half of book value. As the economic crisis of 2007 bled into 2009, export-oriented industries suffered. Rumors had been buzzing since October that NDP was on the ropes. It was carrying so much debt that more than one analyst was asking, ‘‘Will they go bust?’’ Was the financial crisis of 2008 about to claim another victim, or had friction between the global economic crisis and the company’s debt ignited jittery nerves in the global markets? THE CHAIRLADY Cheung Yan, or Mrs. Cheung as she preferred, was the visionary force behind NDP’s success. Her empire had been built from trash—discarded cardboard cartons, to be precise. The cartons were collected in the U.S. and Europe, shipped to China, then pulped and re-manufactured into paperboard. NDP customers then used the paperboard to package goods that were shipped back to the U.S. and Europe where the cycle was repeated. ‘‘Wastepaper is a forest,’’ a former boss once told Mrs. Cheung. NDP had worked to perfect the harvesting of that forest. Born in 1957, Mrs. Cheung came from a modest family background yet through hard work, perseverance and savvy business strategy she built a company that was a dominant force in the industry. She had started as an accountant for a Chinese trading company in Hong Kong; after her employer failed, she started her own company to deal in scrap paper. In 1990 she moved to the U.S. to start another company, American Chung Nam Incorporated (ACN), to capture the waste paper stream there. ORIGINS It is the largest of scaly animals, and it has the following nine characteristics. Its head is like a camel’s, its horns like a deer’s, its eyes like a hare’s, its ears like a bull’s, its neck like an iguana’s, its belly like a frog’s, its scales like those of a carp, its paws like a tiger’s, and its claws like an eagle’s. It has nine times nine scales, it being the extreme of a lucky number. —www.ninedragonbaguazhang.com/ dragons.htm

One of the first companies to export waste paper from the U.S. to China, ACN started by collecting waste paper from dumps, then expanded its network to include grocery stores, waste haulers and waste paper collectors. Mrs. Cheung negotiated favorable contracts with shipping companies whose ships were returning to China empty after unloading goods in North America. ACN soon expanded abroad and became a leading exporter of recovered paper from Europe and Asia to China. By 2001, ACN had become the largest exporter, by volume, of freight from the United States. ‘‘In other words, nobody in America was shipping more of anything each year anywhere in the world.’’2 The Chinese economic miracle which began in the late 1990s rose on the back of exports of consumer goods which required massive quantities of packaging material. Within a few years, the demand for packaging outgrew what domestic suppliers could provide. Seizing the opportunity, Mrs. Cheung founded Nine Dragons Paper Industries Company in Dongguan, China in 1995. By 1998, the first papermaking machine (PM1) was installed and running. NDP expanded rapidly and by 2008 it had 22 paperboard manufacturing machines at five locations in China and Vietnam producing 7.85 million ![]() annually. EXPANSION ‘‘The market waits for no one. If I don’t develop today, if I wait for a year, or two or three years, to develop, I will have nothing for the market, and I will miss the opportunity.’’3 —Cheung Yan, co-founder and Chairwoman of Nine Dragons Paper

annually. EXPANSION ‘‘The market waits for no one. If I don’t develop today, if I wait for a year, or two or three years, to develop, I will have nothing for the market, and I will miss the opportunity.’’3 —Cheung Yan, co-founder and Chairwoman of Nine Dragons Paper

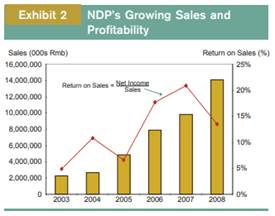

Even with capacity expansion across the Chinese paperboard industry, the demand for paperboard surpassed production. In 2005 Chinese manufacturers produced nearly 28 million tonnes of containerboard, yet consumption equaled 30 million tonnes. The output gap had narrowed over the past decade, yet despite its standing as the largest containerboard manufacturing country in the world, China remained a net importer. Since its founding, NDP had expanded production capacity rapidly, as illustrated in Exhibit 1. The company had three paperboard manufacturing plants in China: (1) Dongguan, in Guangdong Province in the Pearl River Delta; (2) Taicang, in Jiangsu Province in the Yangtze River Delta region; and (3) Chongqing, in Sichuan Province in western China. All three were strategically located close to consumer goods manufacturers and shipping ports. NDP also had three other major investments to support its paperboard manufacturing: (a) a specialty board producer in Sichuan Province; (b) a joint venture in a pulp manufacturer in Inner Mongolia (55% interest); and (c) a joint venture in a pulp manufacturer and paper mill in Binh Duong Province, Vietnam (60% interest). NDP by 2008 was the largest paperboard manufacturer in Asia. If planned expansion was completed, NDP would become the largest paperboard manufacturer in the world by the end of 2009. Mrs. Cheung believed that expansion and its resultant economies of scale were the primary drivers in increasing profit margins. And in fact, looking at the company’s sales and profit growth over the previous years (Exhibit 2), this did not appear to be a company that should be on the brink of bankruptcy. In papermaking, expansion required significant capital outlay and a long term outlook. For example, a papermaking machine cost $100 to $200 million to purchase and setup, and even then it might take up to two years before it reached

optimal productivity. But all things considered, sales had continued to grow—even faster, although the rate of profitability had fallen in 2008.

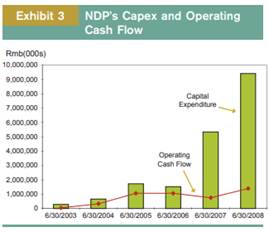

FINANCING EXPANSION ‘‘Why are we in debt?’’ she asked. ‘‘I didn’t misuse this money on derivatives or something! I took a high level of risk because that is the preparation for the future, so that we will be first in the market when things change.’’4 —Cheung Yan, co-founder and Chairwoman of Nine Dragons Paper Historically, NDP had funded capital expenditure with a combination of operating cash flow and bank borrowings. But the increasing rate of expansion, as illustrated in Exhibit 3, meant that the company needed a sizeable injection of outside capital. In March 2006, NDP offered 25% of the company’s equity, one billion shares, at an

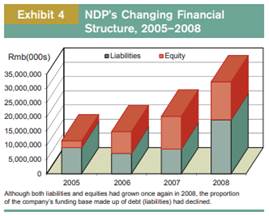

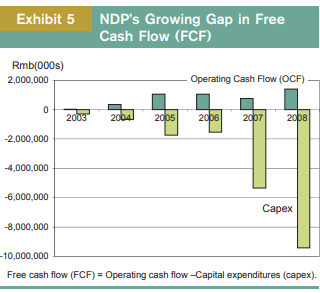

offer price of HK$ 3.40 per share. Within six months the stock (HK:2689) was a constituent stock of the Hang Seng Composite Index and by the end of the year the price had increased nearly 400%, to HK$ 13.28, making Mrs. Cheung, who had retained 72% interest, the richest woman in China. The proceeds from the IPO allowed NDP to retire a large portion of its accumulated debt. But as Mrs. Cheung increased the rate of asset growth, capital expenditure outpaced operating cash flow, generating a negative free cash flow. (Free cash flow is generally defined in industry practice as operating cash flow less capital expenditure, capex.)When financial markets ground to a halt in the fall of 2008 and the economic crisis spread around the globe, export orders dropped 50%, sales revenue plummeted, and the debt burden became noticeably heavier. In April 2008 NDP had issued $300 million in senior unsecured notes, notes that Fitch rated BBB-. This was the very edge of investment grade, and typical for the industry. Fitch had cited many factors common to the industry in its initial rating: the current economy, raw material price increases and supply risk—but specific to NDP, it noted the aggressive capital expenditure program. As price pressure from raw materials continued and the company’s leverage increased, Fitch downgraded NDP to BB+ in October 2008, speculative grade, and as markets tumbled, to BB- in December.5 NDP’s management team had argued that by the end of 2008 the company’s financial structure had improved, not worsened, as shown in Exhibit 4.

OPERATIONS AND INNOVATION ‘‘We only have a certain number of opportunities in our lifetime. Once you miss it, it’s gone forever.’’6 —Cheung Yan, co-founder and Chairwoman of Nine Dragons Paper From the beginning, the company had invested in the most advanced equipment available, importing papermaking machines from the U.S. and Italy. Each plant was constructed with multiple production lines, allowing flexible configuration. This allowed the company to offer a diversified product portfolio to its customers with options including product types, sizes, grades, burst indices, stacking strengths, basis weights and printability. Five principal products were available in over 60 basis weights and over 1,000 different sizes and type specifications. This flexibility allowed responsiveness to customer demand. NDP had become an innovation

leader in the industry. Equipment utilization rates consistently averaged 94%, surpassing the industry average. Containerboard manufacture demands an uninterrupted supply of electricity, consumes large quantities of water and generates noxious waste products. NDP constructed water treatment plants, waste treatment facilities, coal fired cogeneration power plants and transportation infrastructure to support its operations. These facilities generated operational efficiencies and cost controls while also reducing their environmental impact as much as possible in an historically dirty industry. The Chinese government had imposed increasingly strict regulations to limit environmental impact and compliance was costly: expenses associated with environmental compliance had led to the closing of more than 550 small paper mills in 2008 alone. Water was used as efficiently as possible. At all of its plants, NDP had constructed its own water conservation and recycling system. The system reduced consumption by taking advantage of differences in water quality requirements of different production lines. For example, water used by one production line was treated and reused before being treated again and discharged into the environment. This innovation resulted in water usage of 6 to 15 tonnes per tonne of production, less than half the international standard. NDP also found that if it controlled the saline levels in the water, it could provide a consistently high quality product to customers. Waste treatment facilities were constructed at all manufacturing plants. Their purposes were three-fold: to capture part of the waste stream for reuse, to re-enter paper pulp into the production stream, and to channel remaining waste into an energy boiler for incineration. Coal fired co-generation power plants were constructed to supply the plants in Dongguan, Taicang and Chongqing. The cost of power was reduced by approximately one third, steam generated as a byproduct was redirected to the production line for use in the drying process and surplus electricity was sold to the regional power grid. In the future, this surplus power could support additional capacity expansion. Also, the power plants were equipped with particulate filtration and desulphurization equipment to reduce pollution. The company also owned and operated its own transportation infrastructure, including piers and unloading facilities, railway spurs, and truck fleets. The company received shipments of raw materials, including recovered paper, chemicals and coal, at its self-owned piers in Taicang and Chongqing and at the Xinsha Port in Dongguan. These facilities took advantage of ocean and inland waterway transportation, reducing port loading and unloading charges, and allowed the company to avoid transportation bottlenecks. RAW MATERIALS ‘‘Wastepaper is like a forest. Paper recycles itself, generation after generation.’’7 —Cheung Yan, co-founder and Chairwoman of Nine Dragons Paper Recovered paper and kraft pulp are the principal raw materials used in the manufacture of paperboard; therefore, the ability to consistently source large volumes of high quality recovered paper is critical to success in the industry. To ensure supply of manufacturing inputs, NDP had secured long-term contracts with American Chung Nam to supply up to 80% of its recovered paper needs. To establish a secure source of wood pulp, NDP entered into a joint venture with China Inner Mongolia Forestry Industry Company, a state owned enterprise, in 2004. In 2008 NDP acquired a wood and bamboo pulp/ specialty paper project in Leshan, Sichuan, and in May 2008 acquired Sichuan Rui Song Paper Company which would provide additional supplies of kraft and bamboo pulp.

PAPERBOARD AND THE PACKAGING INDUSTRY The paper industry in China mirrored the global paper industry—resource hungry and dominated by large domestic players. Lee & Man Paper Manufacturing Limited was NDP’s strongest competitor in China. Also founded in 1995, it also focused on containerboard and also added capacity rapidly, producing 2.88 million tonnes in 2008. Together, NDP and Lee and Man Paper accounted for 24% of domestic production in 2008.8 Other paper manufacturers in China were generally smaller, older, and more diversified. International companies, though large enough to compare with NDP, typically had a broader focus and were vertically integrated into other paper related market segments. Because production in the industry was not labor intensive, the low labor cost advantage in China added little value; and because shipping costs were high on a value-to-volume basis, it was not cost effective to manufacture far from customers. Global demand for consumer goods had been the primary driver of China’s manufacturing and export-led growth over the past decade. Conversely, given the manufacturing slowdown resulting from the 2007 global economic crisis, some industry experts expected that future demand might not match the anticipated capacity\

increase in the paperboard industry. Already, production had slowed. In fact, the demand for raw materials had decelerated so rapidly that scrap paper was ‘‘backing up in America like a clogged drain.’’9

PROSPECTS Our future path of development may remain thorny ahead, but armed with the shared confidence and courage throughout the Group to overcome and conquer, we are poised to act even more diligently and powerfully to prepare for the next global economic recovery. —‘‘Chairlady’s Statement,’’ 2008/09 Interim Report, Nine Dragons Paper (Holdings) Limited Nine Dragons Paper was being squeezed by declining markets, burdensome debt—and possibly—just possibly, some market hysteria. As the economic crisis of 2007 continued into 2009, many of NDP’s customers simply disappeared. Mrs. Cheung’s focused determination had guided NDP to its present industry leadership position. NDP’s management team wondered if the growing gap between operating cash flow and capex in recent years was dominating the market’s thinking. That gap, as seen in Exhibit 5, was indeed large, but it was a gap that had always been filled opportunistically with debt. Would this time be different? More than 670,000 Chinese businesses had failed in 2008. Would NDP be next?

Case Questions

1. How would you characterize the way in which Mrs. Cheung has gone about building NDP?

2. In your opinion, do you believe NDP’s approach to rapid capacity expansion is too risky?

3. What actions would you recommend to NDP to stop the market’s attack on its financial viability?