ICELAND 2006—A SMALL COUNTRY IN A GLOBAL CAPITAL MARKET

More than almost anything, Icelanders like a soak in hot water. Reykjavik has more thermal spas per head than any other city in the world. But lately, the North Atlantic nation has been feeling more heat than it bargained for. On February 1st Fitch, a rating agency, cut its outlook on Icelandic sovereign debt to negative from stable, drawing attention to a current-account deficit that ballooned to 15% of GDP in 2005 and fast-raising foreign debt. With only 300,000 people and an economy one third the size of Luxembourg’s, Iceland’s troubles may sound like the fabled headline, ‘‘Small earthquake: not many dead.’’ But dire warnings of contagion have flourished out of all proportion to the country’s size.

‘‘Storm in a Hot Tub,’’ The Economist, March 30, 2006

The last one or two years had been something of a shock to the Icelandic people. Long used to being ignored in the world, Iceland’s economic situation and its interest rates—some of the highest in the world recently—had suddenly garnered much international attention. Now, in the spring of 2006, Iceland’s central bank and governmental monetary authorities were wondering whether they were seeing the dark underside of globalization and economic growth. Is this what it felt like to be a small country in a global market?

OVERHEATING

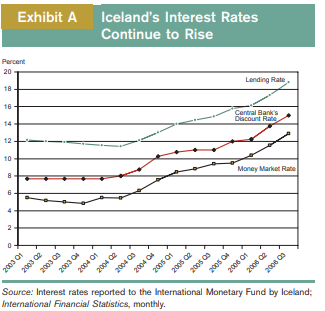

Iceland’s economy had been growing at record rates in recent years. Gross domestic product had grown at just over 8 percent in 2004, 6 percent in 2005, and was expected to be still above 4 percent by the end of the current year, 2006. While the average unemployment rate of the major economic powers was roughly 6 percent, Iceland’s overheating economy had only 3 percent unemployment. But accompanying rapid economic growth in a small economy, as happens frequently in economic history, inflation raises its ugly head. And the requisite prescription for such an ailment by monetary authorities is also well known: slowing money supply growth to try and control inflationary forces. The result is always the same—increasing interest rates, as illustrated in Exhibit A. These higher interest rates had a number of different impacts. First, Iceland was considered very stable and low risk in the international marketplace. It—the Icelandic government—had an investment grade credit rating. So foreign investors, particularly the money market investors

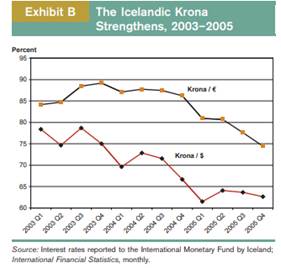

behind the carry-trade made famous in Japan, found Icelandic money market interest rates very attractive. Capital from foreign investors, American and European, flowed into the big four Icelandic banks and money market accounts of all kinds to take advantage of these higher money market rates. But the carry-trade depends on exchange rates as well as interest rates. A foreign investor exchanging U.S. dollars or euros for Icelandic krona, and then investing in the higher yielding money market rates in Iceland, must feel relatively confident that the krona will not fall in value versus their currency by the time they need to bring the money back home. And they did. The krona had actually strengthened consistently against both the dollar and the euro in 2004 and 2005, as illustrated in Exhibit B. By the end of 2005 the krona was stronger against both the dollar and the euro than it had been since 2000. A less desirable result of this process is that interest rates rise for everyone, including domestic Icelandic companies wishing to borrow money. Monetary policies like these have been known to bring domestic business to a standstill—which is in many ways the intent—to slow business forces driving inflation. But Iceland and many Icelandic companies were more and more global, and when borrowing rates (‘‘lending rates’’) continued to rise in 2004 and 2005, they started borrowing abroad. Any company that could raise debt outside of Iceland, in Europe in euros for example, did.

THE ICELANDIC CHILL But as the krona continued to strengthen against other major currencies, its export competitiveness declined. Iceland’s current account, already in deficit, began to skyrocket in size. Iceland’s current account deficit was 16 percent of its gross domestic product (GDP) at the end of 2005, and was expected to stay that high through the remainder of 2006. For comparison, the current account deficits of note of other countries were only half that of Iceland’s: New Zealand (8 percent), Hungary (7 percent), and even the United States (6 percent). Not only was Iceland’s current account in deficit, but the size of its outstanding debt in total, accumulated over a number of years, was troublesome. Suddenly, in February 2006, things changed. Capital started flowing out of Iceland. The size of the country’s current account deficit had become front page news, and major investors, including those in the carry trade, feared that the krona would fall undermining their interest arbitrage gains. Foreign investors dumped krona at a record rate. Adding to ‘‘global stress,’’ as one journalist put it, was the possibility that the fears over the Icelandic economy would spread to other countries and currencies around the world. Although in the end relatively minor, many small country and emerging market ![]() suffered short term falls as the markets feared a general spread or contagion as that seen during the Asian crisis in 1997. ‘‘These countries may be unrelated geographically but they are not unrelated in portfolios,’’ said Tony Nor field, global head of FX strategy at ABN

suffered short term falls as the markets feared a general spread or contagion as that seen during the Asian crisis in 1997. ‘‘These countries may be unrelated geographically but they are not unrelated in portfolios,’’ said Tony Nor field, global head of FX strategy at ABN ![]() . ‘‘What starts as a trimming back of a position can turn into an avalanche.’’ A financial crash in Iceland snowballed yesterday, setting off a series of tremors as far afield as Brazil and South

. ‘‘What starts as a trimming back of a position can turn into an avalanche.’’ A financial crash in Iceland snowballed yesterday, setting off a series of tremors as far afield as Brazil and South

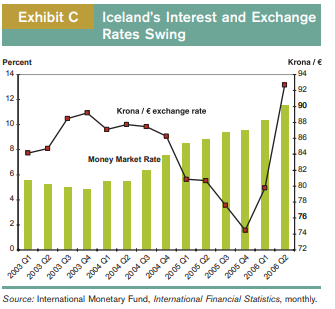

Africa. At one point the Icelandic krona was down 4.7 percent at a 15-month low of IKr69.07 to the dollar, having fallen a further 4.5 percent on Tuesday, its biggest one-day slide in almost five years. The krona’s collapse meant carry trade investors who borrowed in euros to gain exposure to Reykjavik’s 10 percent interest rate, saw one and-a-half years’ worth of carry trade profit wiped out in less than two days. The collapse, which was sparked by Fitch downgrading its outlook on Iceland, citing fears over an ‘‘unsustainable’’ current account deficit and drawing parallels with the imbalances evident before the 1997 Asian crisis, led to a ![]() sell-off in Icelandic assets. The crash sparked a selloff among hitherto strong performing emerging market currencies across the globe, with the Brazilian real falling almost 3 percent at one point and the Turkish lira, South African rand, Mexican peso and Indonesian rupiah each losing at least 1 percent, before recovering later in the session. Currencies markets were awash with talk of a rising tide of risk aversion, with traders exiting carry trades around the globe. However, the truth appeared to be more prosaic, with the emerging market contagion caused by investors cutting profitable positions in order to plug their Icelandic losses. ‘‘We have had a car crash in Iceland and people will have closed their winning positions in order to fund their losses,’’ said David Bloom, currency analyst at HSBC. This trend snowballed as selling from Mexico to Indonesia exacerbated losses causing traders to cash in yet more profits to balance their positions. ‘‘Iceland’s Collapse Has Global Impact,’’ Financial Times, Feb 23, 2006, p. 42 Over the following two quarters the Icelandic krona plummeted in value against the euro and the dollar, although money market interest rates were still high and attractive in relative terms. But investors were no longer convinced. Their fear of a falling krona had become a self-fulfilling prophecy. In the end, the speculators caused to happen exactly what they feared would happen: a weaker Icelandic krona.

sell-off in Icelandic assets. The crash sparked a selloff among hitherto strong performing emerging market currencies across the globe, with the Brazilian real falling almost 3 percent at one point and the Turkish lira, South African rand, Mexican peso and Indonesian rupiah each losing at least 1 percent, before recovering later in the session. Currencies markets were awash with talk of a rising tide of risk aversion, with traders exiting carry trades around the globe. However, the truth appeared to be more prosaic, with the emerging market contagion caused by investors cutting profitable positions in order to plug their Icelandic losses. ‘‘We have had a car crash in Iceland and people will have closed their winning positions in order to fund their losses,’’ said David Bloom, currency analyst at HSBC. This trend snowballed as selling from Mexico to Indonesia exacerbated losses causing traders to cash in yet more profits to balance their positions. ‘‘Iceland’s Collapse Has Global Impact,’’ Financial Times, Feb 23, 2006, p. 42 Over the following two quarters the Icelandic krona plummeted in value against the euro and the dollar, although money market interest rates were still high and attractive in relative terms. But investors were no longer convinced. Their fear of a falling krona had become a self-fulfilling prophecy. In the end, the speculators caused to happen exactly what they feared would happen: a weaker Icelandic krona.

Case Questions

1. Do you think a country the size of Iceland or New Zealand is more or less sensitive to the potential impacts of global capital movements?

2. Many countries have used interest rate increases to protect their currencies for many years. What are the pros and cons of using this strategy?

3. In the case of Iceland, the country was able to sustain a large current account deficit for several years, and at the same time have ever-rising interest rates and stronger currency. Then one day, it all changed. How does that happen?