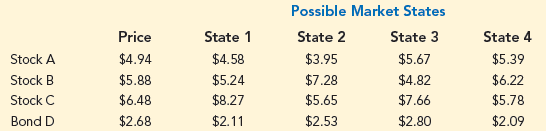

An investor wishes to invest $10,000 for the coming year and anticipates that the market will be in one of four different states at the end of the year. These states affect her investments in each of three possible stocks and a bond as shown in the following table. Unfortunately, she is uncertain about which market state will occur. Because she is risk-averse, the investor would like to invest in a manner so that the return in the worst-case, no matter what market state occurs, is as good as possible. The following table provides the current price of each possible instrument as well as projected yearend prices of each instrument under each of the 4 possible states.

These data are in the file MarketStates. Formulate her investment problem as a linear program and solve it using Excel Solver. How much should she invest in each security? Note: It is possible to purchase fractional shares.