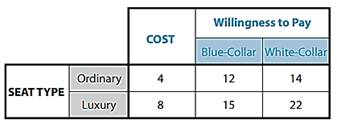

Cheapskates is a very minor-league professional hockey team. Its facilities are large enough to accommodate all of the 1,000 fans who might want to watch its home games. It can provide two types of seats—ordinary and luxury. There are also two sorts of fans: 60% of the fans are blue-collar fans, and the rest are white-collar fans. The costs of providing each type of seat and the fans’ willingness to pay for each type of seat are given in the following table (measured in dollars):

Each fan will buy at most one seat, depending on the consumer surplus he would get (maximum willingness to pay minus the actual price paid) from the two kinds. If the surplus for both is negative, then he won’t buy any. If at least one kind gives him nonnegative surplus, then he will buy the kind that gives him the larger surplus. If the two kinds give him equal, nonnegative surplus, then the blue-collar fan will buy the ordinary kind of seat, and the white-collar fan will buy the luxury kind. The team owners provide and price their seating to maximize profit, measured in thousands of dollars per game. They set prices for each kind of seat, sell as many tickets as are demanded at these prices, and then provide the numbers and types of seats of each kind for which the tickets have sold.

(a) First, suppose the team owners can identify the type of each individual fan who arrives at the ticket window (presumably by the color of his collar) and can offer him just one type of seat at a stated price, on a take-it-or-leave-it basis. What is the owners’ maximum profit, p*, under this system?

(b) Now, suppose that the owners cannot identify any individual fan, but they still know the proportion of blue-collar fans. Let the price of an ordinary seat be X and the price of a luxury seat be Y. What are the incentive-compatibility constraints that will ensure that the blue-collar fans buy the ordinary seats and the white-collar fans buy the luxury seats? Graph these constraints on an X-Y coordinate plane.

(c) What are the participation constraints for the fans’ decisions on whether to buy tickets at all? Add these constraints to the graph in part (b).

(d) Given the constraints in parts (b) and (c), what prices X and Y maximize the owners’ profit, p2, under this price system? What is p2?

(e) The owners are considering whether to set prices so that only the white-collar fans will buy tickets. What is their profit, pw, if they decide to cater to only the white-collar fans?

(f) Comparing p2 and pw, determine the pricing policy that the owners will set. How does their profit achieved from this policy compare with the case of full information, where they earn p*?

(g) What is the “cost of coping with the information asymmetry” in part (f)? Who bears this cost? Why?