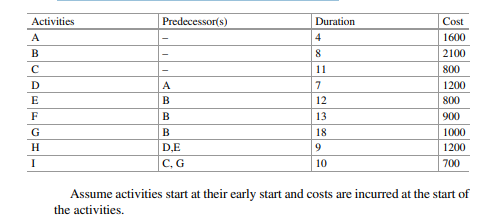

You are asked to calculate a bid value for a project using the payments at the event occurrences model. The annual interest rate is set at 12% and the mark-up is taken as 15%. The Project Portfolio Manager wants to see a comparison of two methods where in one the activity costs are distributed over the KEs whenever there is a direct path from that activity to the KE; and where in the other method the activity costs are charged in total to the KE with the closest occurrence time to the completion time of that activity. The two KEs are the completion event of both activities C and G (event 4); and the project completion event (event 6). The durations are given in days.