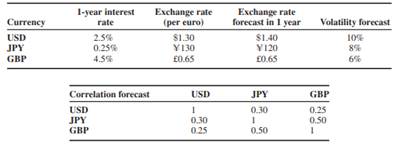

Currency portfolio. It is recommended that you solve this problem using a spreadsheet. You are a euro-zone investor with 1 billion euros to be invested in dollars (USD), yen (JPY), or pounds sterling (GBP). You are given the following market data and forecasts:

(a) Plot the three currencies on a risk-return chart, taking the interest produced by each currency into account.

(b) Draw the risk-return evolution of a portfolio which gradually switches from dollars to yen (i.e. 100% in dollars initially, then 90% in dollars and 10% in yen, etc.). Repeat this question for a portfolio which gradually switches from yen to pounds, and then from pounds to dollars.

(c) Plot the risk-return profiles of all possible portfolios made of the three currencies, considering only long investment positions in multiples of 5%.

(d) Which portfolio would you choose to obtain an expected return around 5.25%? Is this choice optimal?