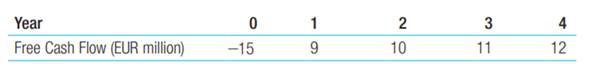

Etemadi Amalgamated, a U.S. manufacturing firm, is considering a new project in Portugal. You are in Etihad’s corporate finance department and are responsible for deciding whether to undertake the project. The expected free cash flows, in EUR, are shown here:

You know that the spot exchange rate is S = 1.15 USD/EUR. In addition, the risk-free interest rate on USD is 4% and the risk-free interest rate on EUR is 6%. Assume that these markets are internationally integrated and the uncertainty in the free cash flows is not correlated with uncertainty in the exchange rate. You determine that the USD WACC for these cash flows is 8.5%. What is the USD present value of the project? Should Etemadi Amalgamated undertake the project?