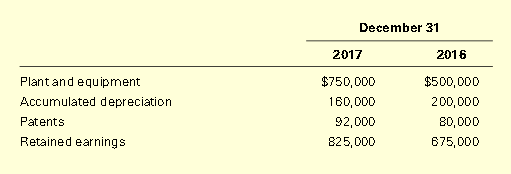

The following account balances are taken from the records of Martin Corp. for the past two years.

Other information available for 2017 is as follows:

a. Net income for the year was $200,000.

b. Depreciation expense on plant and equipment was $50,000.

c. Plant and equipment with an original cost of $150,000 were sold for $64,000. (You will need to determine the book value of the assets sold.)

d. Amortization expense on patents was $8,000.

e. Both new plant and equipment and patents were purchased for cash during the year.

Required

Indicate, with amounts, how all items related to these long-term assets would be reported in the 2017 statement of cash flows, including any adjustments in the Operating Activities section of the statement. Assume that Martin uses the indirect method.