Refer to all of the facts in Problem 12-9.

Required

1. Prepare a balance sheet at December 31, 2017.

2. Using the format in the chapter’s appendix, prepare a statement of cash flows work sheet.

3. Prepare a statement of cash flows for 2017 using the indirect method in the Operating Activ-ities section.

4. Provide a possible explanation as to why Terrier decided to issue additional bonds for cash during 2017.

PROBLEM 12-9

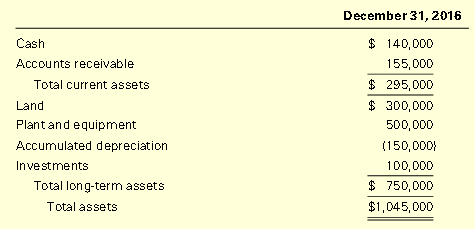

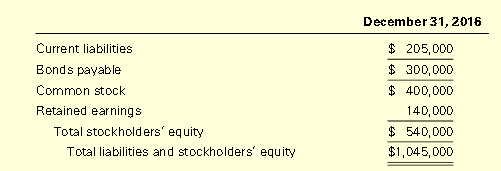

The balance sheet of Terrier Company at the end of 2016 is presented here, along with certain other information for 2017:

Other information is as follows:

a. Net income for 2017 was $70,000.

b. Included in operating expenses was $20,000 in depreciation.

c. Cash dividends of $25,000 were declared and paid.

d. An additional $150,000 of bonds was issued for cash.

e. Common stock of $50,000 was purchased for cash and retired.

f. Cash purchases of plant and equipment during the year were $200,000.

g. An additional $100,000 of bonds was issued in exchange for land.

h. During the year, sales exceeded cash collections on account by $10,000. All sales are on account.

i. The amount of current liabilities remained unchanged during the year.

Required

1. Prepare a statement of cash flows for 2017 using the indirect method in the Operating Activ-ities section. Include a supplemental schedule for noncash activities.

2. Prepare a balance sheet at December 31, 2017.

3. Provide a possible explanation as to why Terrier decided to issue additional bonds for cash during 2017.