Dividends, Stock Splits, and Stockholders’ Equity

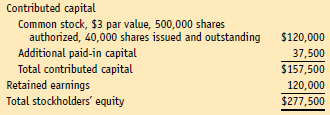

The stockholders’ equity section of Waterbury Linen Mills, Inc., as of December 31, 20×6, was as follows:

A review of the stockholders’ equity records of Waterbury Linen Mills, Inc., disclosed the following transactions during 20×7:

Mar. 25 The board of directors declared a 5 percent stock dividend to stockholders of record on April 20 to be distributed on May 1. The market value of the common stock was $21 per share.

Apr. 20 Date of record for stock dividend.

May 1 Issued stock dividend.

Sept. 10 Declared a 3-for-1 stock split.

Dec. 15 Declared a 10 percent stock dividend to stockholders of record on

January 15 to be distributed on February 15. The market price on this date is $9 per share.

Required

1. Record the stockholders’ equity components of the transactions for Waterbury

Linen Mills, Inc., in T accounts.

2. Prepare the stockholders’ equity section of the company’s balance sheet as of December 31, 20×7. Assume net income for 20×7 is $247,000.

3. User Insight: If you owned 1,000 shares of Waterbury Linen Mills stock on May 1, 20×7, how many shares would you own on February 15, 20×8? Would your proportionate share of the ownership of the company be different on the latter date than it was on the former date? Explain your answer.