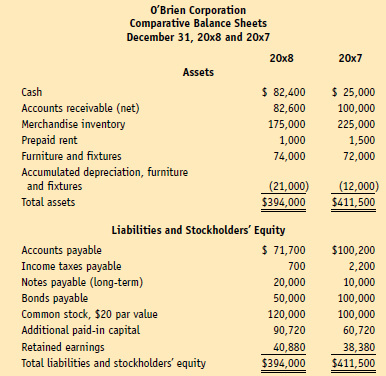

O’Brien Corporation’s comparative balance sheets as of December 31, 20×8 and 20×7 and its income statement for the year ended December 31, 20×8 are presented on the opposite page. During 20×8, O’Brien Corporation engaged in these transactions:

a. Sold furniture and fixtures that cost $17,800, on which it had accumulated depreciation of $14,400, at a gain of $3,500.

b. Purchased furniture and fixtures in the amount of $19,800.

c. Paid a $10,000 note payable and borrowed $20,000 on a new note.

d. Converted bonds payable in the amount of $50,000 into 2,000 shares of common stock.

e. Declared and paid $3,000 in cash dividends.

Required

1. Using the indirect method, prepare a statement of cash flows for O’Brien Corporation. Include a supporting schedule of noncash investing transactions and financing transactions.

2. User Insight: What are the primary reasons for O’Brien Corporation’s large increase in cash from 20×7 to 20×8, despite its low net income?

3. User Insight: Compute and assess cash flow yield and free cash flow for 20×8. Compare and contrast what these two performance measures tell you about O’Brien’s cash-generating ability.