Mattel was forced to deliver a humiliating public apology to ‘‘the Chinese people’’ on Friday over the damaging succession of product recalls of China-made toys that the U.S. toy maker has announced in recent months. In a carefully stagemanaged meeting in Beijing with a senior Chinese official, which, unusually, was open to the media, Thomas Debrowski, Mattel’s executive vice-president for worldwide operations, read out a prepared text that played down the role of Chinese factories in the recalls. ‘‘Mattel takes full responsibility for these recalls and apologises personally to you, the Chinese people, and all of our customers who received the toys,’’ Mr. Debrowski said. The apology was in stark contrast to recent comments from Robert Eckert, Mattel’s chief executive. In testimony to the U.S. Senate last week, he suggested that the fault for the group’s recent product recalls lay with outside contractors. ‘‘We were let down, and so we let you down,’’ he said. —‘‘Mattel in Apology to Chinese,’’ Financial Times, September 22, 2007, p. 15 Bob Eckhart, CEO of Mattel (U.S.), had a problem—a big problem. Mattel had discovered on July 30 that a number of its toys manufactured in China contained lead paint. The following month had seen a series of recalls, rising political tensions between the United States and Chinese governments, and a suicide. But no company had been in China longer than Mattel; the original Barbie had been created there in 1959. Mattel had a depth of experience and a longevity of relationships which should have prevented the problem. In the end it was those relationships and that longevity that may have contributed to the product safety failures. MATTEL’S SOURCING Mattel had long known the risks associated with a toy product’s value stream. Toys were based on a global supply chain which was highly sensitive to petrochemical (plastics) and labor input costs, environmental and human rights sensitivities to socially responsible and sustainable business practices, transportation and logistic disruptions, border crossings, and cost and time to market—all of which added to risk. Growing concerns and controversies over labor practices had led Mattel to establish its Global Manufacturing Principles in 1997, in which it established principles and practices for all companies and sites that manufactured Mattel products, either company owned or licensed manufacturing. The Global Manufacturing Principles (GMP) were established to confirm the company’s commitment to responsible manufacturing practices around the world. To support the GMP standards the company created the Mattel Independent Monitoring Council (MIMCO). Mattel was highly regarded as the first global consumer products company to apply the system to both its own facilities and core contractors on a worldwide basis. But the problems had still happened. The crisis had actually begun in June when U.S. toy maker RC2 recalled 1.5 million Thomas the Tank Engine products made in Guangdong, the Chinese province adjacent to Hong Kong and long the center for contract manufacturing by Western firms. Mattel had then followed with a disturbing series of three product recalls in less than one month. The first recall of 1.5 million toys of 83 different models was made on August 2, most of which were produced by Lee Der Industrial, a Mattel supplier for 15 years. The toys were found to contain high levels of lead paint, a chemical banned many years ago but still secretly used by manufacturers around the globe in an effort to reduce costs (paint with lead often dried glossier and faster). Lee Der Industrial had knowingly used paint that was not approved by Mattel. The second recall, amounting to more than 18 million toys worldwide, was announced on August 14, only two weeks following the first recall. Products recalled were primarily products of The Early Light Industrial company in China, a Mattel partner for 20 years. The recall included just 436,000 Pixar toy cars over lead paint concerns, but nearly 18 million over the concern that small magnets on some products could be ingested. Early Light had sub-contracted components of the Pixar cars

to Hong Li Da, another Chinese company, which had actually used lead paint. This second announcement resulted in an immediate 6% drop in Mattel’s share price on the New York Stock Exchange. The third recall, announced on September 4, was for 800,000 toys, most of which were accessories for Barbie dolls. Mattel explained that further product testing had indicated they possessed ‘‘impermissible levels’’ of lead paint. The products originated from seven different Chinese factories. This third announcement had prompted the European Union to announce a two-month review of toy product safety for toys sold within the EU, regardless of the source of their manufacture. Chinese manufacturers were the source of 65% of Mattel’s toys. Of those 65%, about one-half were owned by Mattel, and one-half manufactured product for the company under a variety of licensed manufacturing agreements. Mattel still owns the 12 factories which make the majority of its core products like Barbie and Hot Wheels. But for the other roughly 50% of its product lines it relies on a set of vendors, which had included Lee Der Industrial and Early Light. For long-standing relationships like those with Lee Der and Early Light, Mattel allowed the companies to do most of their own product testing as a result of the trust between the two parties. But regardless of who owned the actual manufacturing facility, many of the non-Mattel vendors had inturn out-sourced many components and parts to other businesses. All of the businesses in the complex supply chain were facing the same competitive cost pressures in China—rising wage rates, a shortage of skilled labor in coastal provinces, escalating material and commodity prices—some of which may have been the motivation for suppliers to cut corners and costs. It was, therefore, not clear that outsourced manufacturing was really the culprit in this case, or simply the fact that much of the manufacturing and material industries operating throughout China were relatively fragmented, newly developed, under heavy cost pressures, and generally unregulated. Mattel had long held a very high reputation as being one of the very best at assuring healthy and safe product manufacturing, and had worked diligently with its suppliers to assure their conformity with manufacturing specifications and product safety. The resulting problem was that a number of suppliers in China had used lead paint instead of the paint that Mattel had specified and approved for use. They had done it to cut costs. On September 5th Mattel had told an American Congressional committee that its recall of 17.4m toys containing a small magnet that could be swallowed by children was due to a flaw in the toys’ design, rather than production flaws in China. As for some other toys recalled because of allegedly hazardous levels of lead in their paint, Mattel admitted that it had been overzealous and is likely to have recalled toys that did not contravene American regulations on lead content. CHINA BEARS THE COST OF DEVELOPMENT As Beijing cracks down on unsafe toy exports and demands more testing, many small toy producers in China are feeling a financial squeeze. The increased testing ‘‘has created real havoc for some . . . manufacturers’’ in China, says Ron Rycek, vice-president of toy sales at Hilco Corp., which sells toys such as Sonic Skillball to Toys ‘‘R’’ Us and Amazon.com. Even some companies that are able to keep operating feel the pinch. Manufacturers generally don’t get paid until they ship their products, and they usually take out loans to buy materials, pay wages, and cover other expenses until customers transfer funds. With toys now waiting in warehouses while samples are sent to labs, producers can’t repay those loans as quickly as they had expected. The testing ‘‘is holding up our capital and our warehouse space,’’ says Leona Lam, CEO of Leconcepts Holdings, a Hong Kong– based subcontractor that supplies parts to factories making plastic toys for the likes of Mattel Inc. and Fisher-Price. —‘‘Bottlenecks in Toyland,’’ BusinessWeek, October 15, 2007, p. 52 But regardless of how it had been presented in the press, a multitude of foreign firms selling everything from toothpaste to pet foot to mobile phones had discovered a variety of product defects and health and safety risks in their Chinese-based manufacturing and supplier bases. The question remained, however, as to how much of this risk was inherently ‘‘Chinese’’ and how much was ‘‘low-cost country sourcing’’ in origin. The rising anxieties over Chinese products and their associated risks and returns in 2007 reflected a multitude of different political, economic, and business difficulties. The rapid growth of the Chinese economy was already well-known and well-documented: approximately 5% of all manufactured goods in the world were now Chinese;

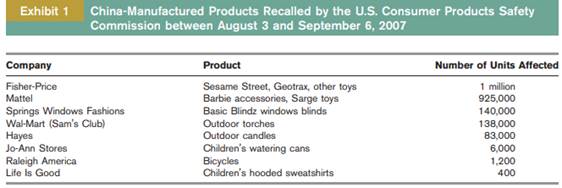

25 percent of all products sold in the United States had significant Chinese content; global commodity prices of oil, copper, molybdenum, steel, and others, were seeing record levels as the rate of infrastructure and business development in China caused global shortages and market pressures. But the costs of such rapid economic development were only now starting to become painfully apparent. The rate of manufacturing growth had far surpassed the ability of the Chinese government on all levels to manage the growth. Regulatory shortfalls—health, safety, and environmental—were now obvious. Although Mattel and other companies were now confessing their own guilt and accepting responsibility for managing their own product risks, the Chinese government was scurrying to not only close regulatory gaps and protect the export customers who were not protecting themselves, but trying to preserve the reputation of Chinese manufacturing and avoid increasing trade restrictions or barriers to their products in foreign markets. The human costs were already high. Zheng Xiaoyu, a former boss of the Chinese State Food and Drug Administration (SFDA), had been executed earlier in the year for taking bribes to approve inferior drugs and certificates claiming that the paint used by Mattel’s suppliers was lead-free. Mr. Zhang Shuhong, the CEO of Lee Der Industrial, the firm which had been the supplier for many of the products included within Mattel’s first product recall, had committed suicide on August 14. Political pressure continued to build between the Chinese government and the United States as the list of products which had been banned by the Consumer Protection Council of the United States continued to grow (see Exhibit 1). The costs of increased regulation were already rising. A survey of consumers in the United Kingdom in September, for example, had found that 37% of the people surveyed noted that the crisis had affected their view of Chinese products overall. As a result, many stated they were much less likely to purchase products made in China. The fall-out from the crisis was indeed no single company, regulatory agency, or government’s fault. But the damage was significant and lasting.

Case Questions

1. Mattel’s global sourcing in China, like all other toy manufacturers, was based on low-cost manufacturing, low-cost labor, and a growing critical mass of factories competitively vying for contract manufacturing business. Do you think the product recalls and product quality problems are separate from or part of pursuing a low-cost country strategy?

2. Whether it is lead paint on toys or defective sliding sides on baby cribs, whose responsibility do you think it is to assure safety––the company, like Mattel, or the country, in this case China?

3. Many international trade and development experts argue that China is just now discovering the difference between being a major economic player in global business and its previous peripheral role as a low-cost manufacturing site on the periphery of the world economy. What do you think?