IF TOO LONG, PLEASE PUT THE REST IN THE COMMENT SECTION

Financial Analysis Case 1 – Under Armour

Search Google or any other search engine to help you better understand the business at Under Armour.

Then read Under Armour's 2016 Annual Report, found in this Module.

As the Chief Financial Officer at Under Armour, what are your recommendations to improve the financial health of the company? Discuss at length. Be thorough in your analysis and write-up.

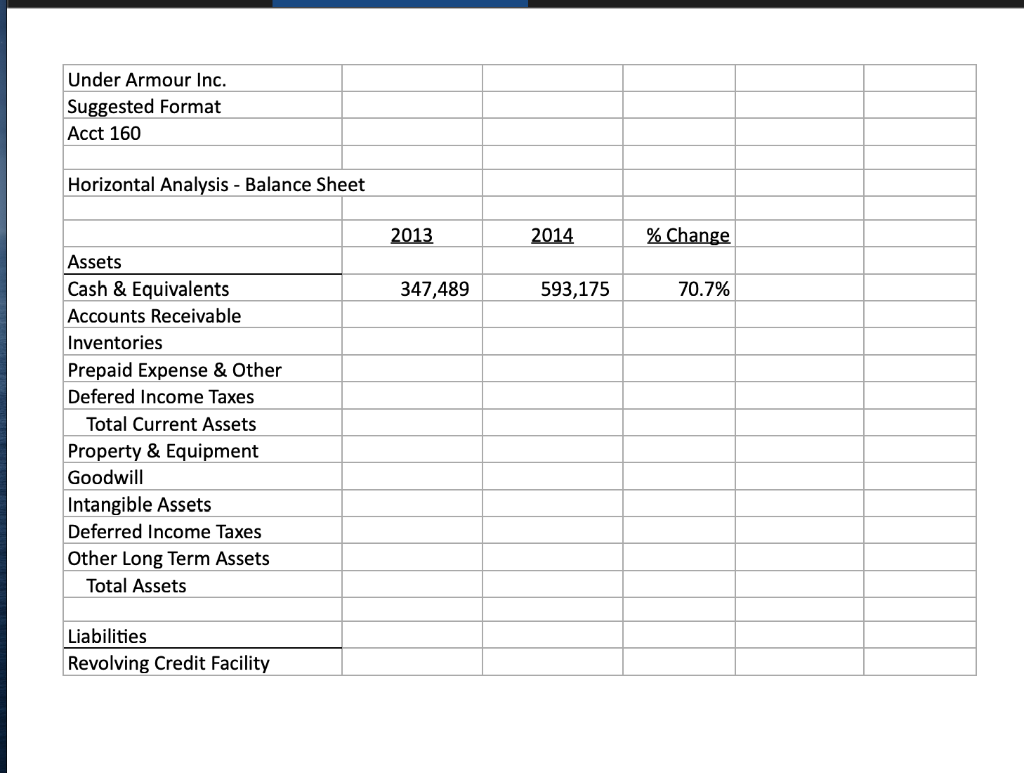

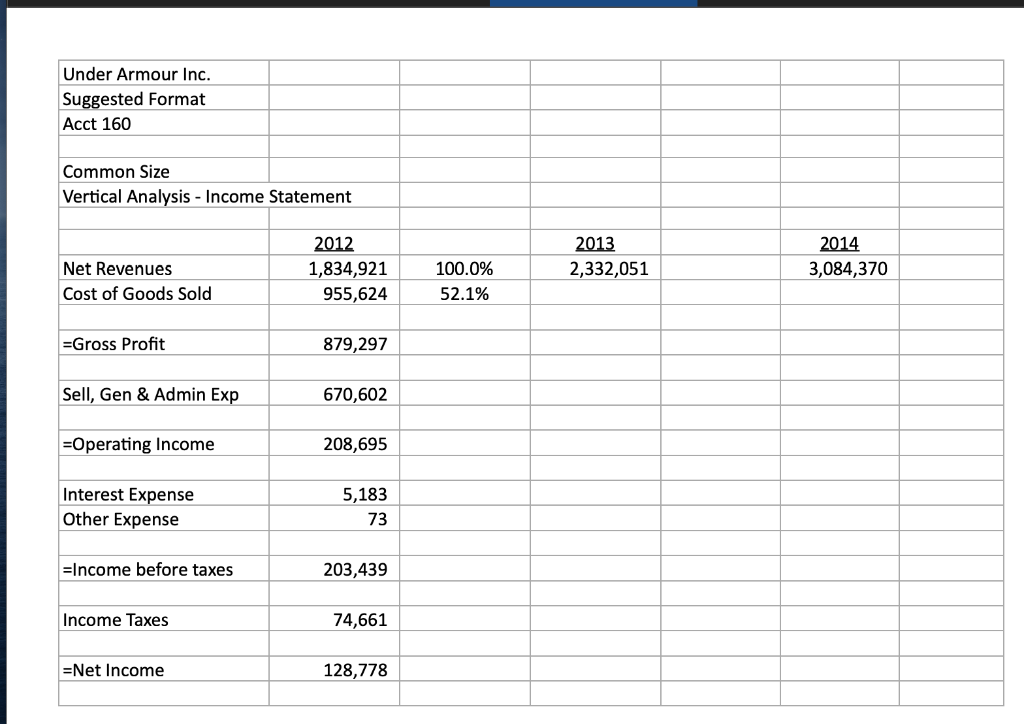

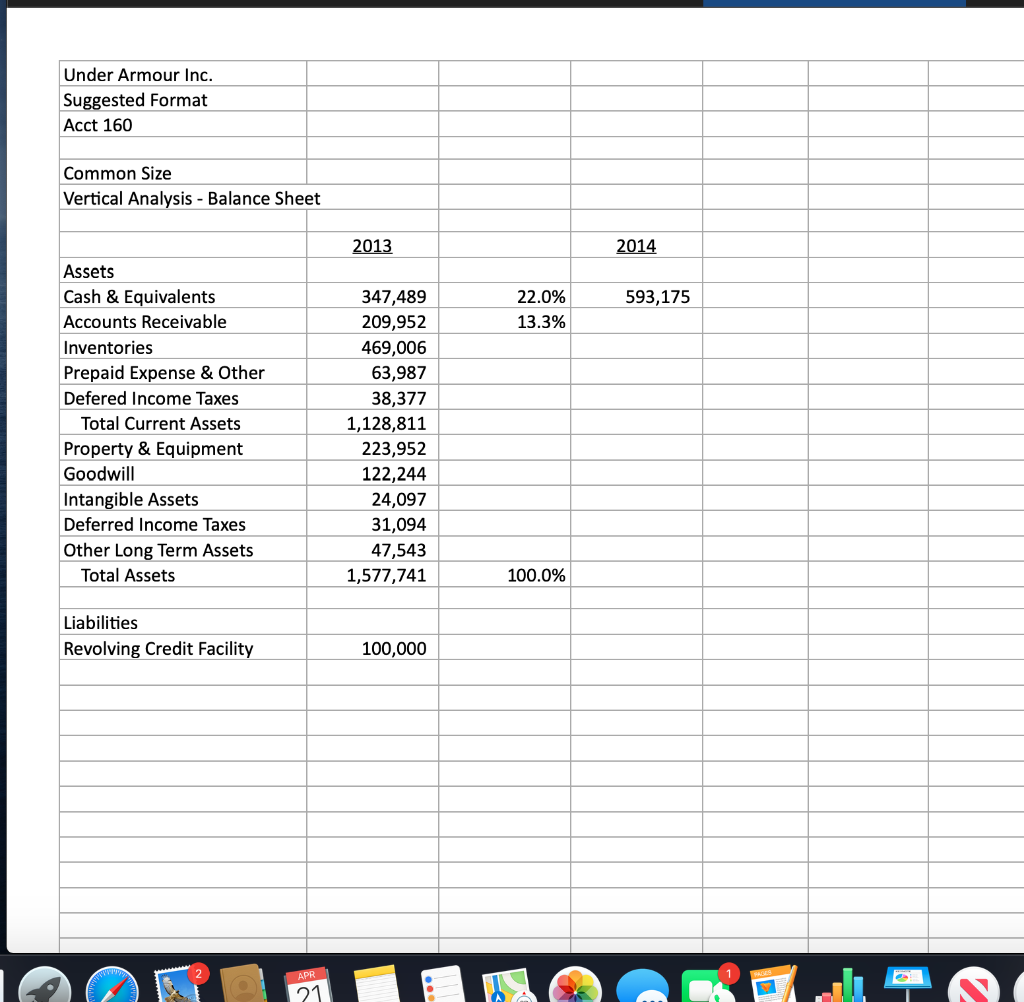

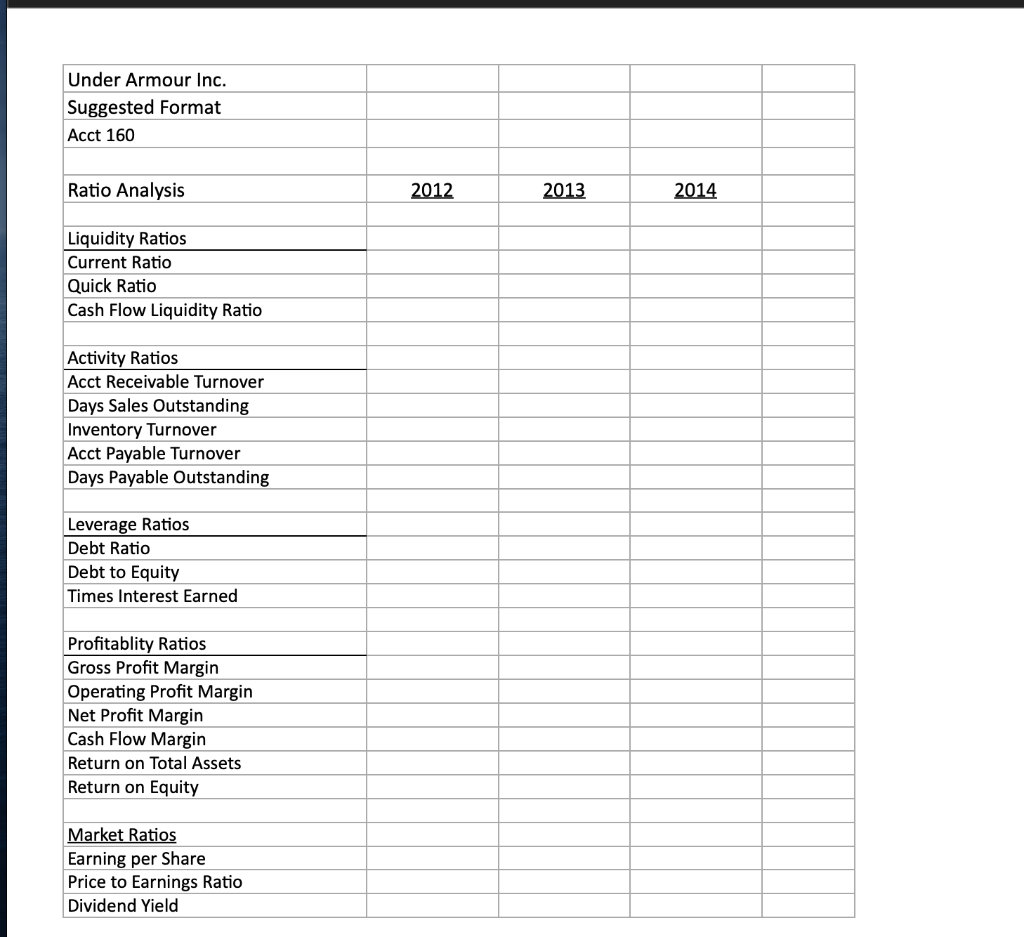

Your analysis must begin with a horizontal analysis and a common size analysis. Then calculate the ratios from the liquidity, activity, leverage, profitability and stock market groups of ratios, as outlined in our chapter.

It is recommended you use Excel for the horizontal analysis and common size analysis, as well as your ratio calculations.