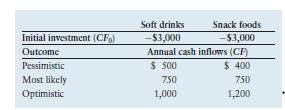

Automated Food Distribution Corp. (AFDC) produces vending machines and places them in public buildings. The company has obtained permission to place one of its machines in a local library. The company makes two types of machines. One distributes soft drinks, and the other distributes snack foods. AFDC expects both machines to provide benefits over a 10-year period, and each has a required investment of $3,000. The firm uses a 10% cost of capital. Management has constructed the table of estimates of annual cash inflows for pessimistic, most likely, and optimistic results shown at the top of the next page.

a. Determine the range of annual cash inflows for each of the two vending machines.

b. Construct a table similar to this one for the NPVs associated with each outcome

for both machines.

c. Find the range of NPVs, and subjectively compare the risks associated with these

machines.