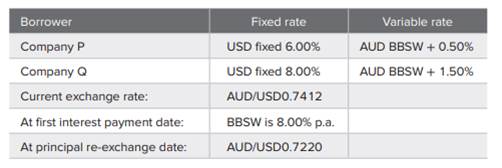

On the basis of the data provided below, and with the knowledge that company P wants to borrow AUD50 million paying a variable interest rate, and that company Q wants to borrow USD30 million paying a fixed interest rate, construct a cross-currency swap. Use diagrams to support your answer.

(a) Construct a direct swap that will benefit both parties. Draw a fully labelled diagram showing the initial cross-currency swap cash flows. Identify and explain the apparent problem that exists with constructing this cross-currency swap. How might this problem be resolved?

(b) Show the currency and interest rates that will be applicable on the first interest payment date. Assume net differential is split 60/40 in favour of the stronger company P.

(c) Indicate the flow of funds at the re-exchange of principal (ignore interest payments that will also be due on the re-exchange date), and indicate whether either party will realise an FX loss on the re-exchange of principal. (LO 21.3)