Kirsten Neal is interested in purchasing a new house given

that mortgage rates are low. Her bank has specific rules regarding an applicant’s

ability to meet the contractual payments associated with the requested debt.

Kirsten must submit personal financial data for her income, expenses, and existing

installment loan payments. The bank then calculates and compares certain ratios to predetermined allowable values to determine if it will make the requested loan. The

requirements are as follows:

(1) Monthly mortgage payments , 28% of monthly gross (before-tax) income.

(2) Total monthly installment payments (including the mortgage payments) , 37%

of monthly gross (before-tax) income.

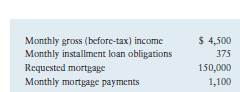

Kirsten submits the following personal financial data:

a. Calculate the ratio for requirement 1.

b. Calculate the ratio for requirement 2.

c. Assuming that Kirsten has adequate funds for the down payment and meets

other lender requirements, will Kirsten be granted the loan?