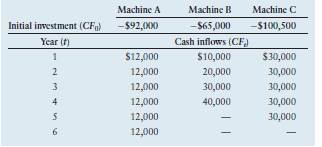

Evans Industries wishes to select the best of three possible machines, each of which is expected to satisfy the firm’s ongoing need for additional aluminum-extrusion capacity. The three machines—A, B, and C—are equally risky. The firm plans to use a 12% cost of capital to evaluate each of them. The initial investment and annual cash inflows over the life of each machine are shown in the following table.

a. Calculate the NPV for each machine over its life. Rank the machines in descending

order on the basis of NPV.

b. Use the annualized net present value (ANPV) approach to evaluate and rank the

machines in descending order on the basis of ANPV.

c. Compare and contrast your findings in parts a and b. Which machine would you

recommend that the firm acquire? Why?