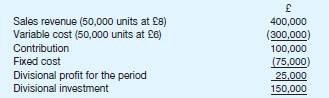

The following information applies to the budgeted operations of the Goodman division of the Telling Company.

The minimum desired return on investment is the cost of capital of 20 per cent a year.

Required:

(a) (1) Calculate the divisional expected ROI (return on investment).

(2) Calculate the division’s expected RI (residual income).

(3) Comment on the results of (1) and (2).

(b) The division has the opportunity to sell an additional 10,000 units at £7.50. Variable cost per

unit would be the same as budgeted, but fixed costs would increase by £5,000. Additional

investment of £20,000 would be required. If the manager accepted this opportunity, by how

much and in what direction would the residual income change?

(c) Goodman expects to sell 10,000 units of its budgeted volume of 50,000 units to Sharp,

another division of the Telling Company. An outside business has promised to supply the

10,000 units to Sharp at £7.20. If Goodman does not meet the £7.20 price, Sharp will buy

from the outside business. Goodman will not save any part of the fixed cost if the work goes

outside, but the variable cost will be avoided completely.

(1) Show the effect on the total profit of the Telling Company if Goodman meets the £7.20 price.

(2) Show the effect on the total profit of the Telling Company if Goodman does not meet

the price and the work goes outside.