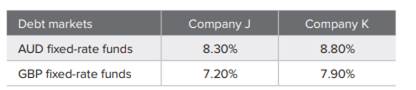

As the treasury sales executive for the National Bank, you approach two of your multinational clients and offer to construct a cross-currency swap that will enable both clients to manage their interest rate and foreign exchange rate risk exposures on their current debt issues. Company J has borrowed AUD14 million and company K has borrowed GBP5 million. Each wishes to swap into the other currency. The current spot exchange rate is GBP/AUD1.60.

You indicate to the clients that any gain obtained from the swap will be split evenly between the companies after the bank has taken a spread of 0.15 per cent.

(a) Draw a fully labelled diagrammatic representation showing the initial cash flows associated with the cross-currency swap.

(b) Draw a fully labelled diagram to show the interest rate flows that will occur at the first interest payment date (show relevant currency and interest rate only—no need to calculate the actual amount).

(c) At the end of the swap agreement, final interest rate payments will be exchanged and the principal amounts will be re-exchanged. Assume that the spot exchange rate has moved to GBP/AUD1.45. Draw a fully labelled diagram showing the interest rate flows (currency and rate only), and principal amount cash flows that will occur at the swap agreement expiry date.

(d) Will either company realise an FX loss at completion of the swap contract? (LO 21.3)