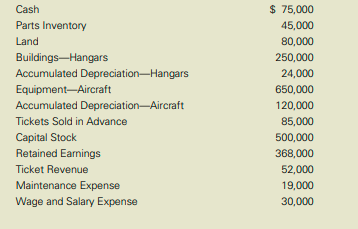

A list of accounts for Northern Airlines at January 31 is shown. It reflects the recurring transactions for the month of January, but it does not reflect any month-end adjustments.

The following additional information is available: a. Airplane parts needed for repairs and maintenance are purchased regularly, and the amounts paid are added to the asset account Parts Inventory. At the end of each month, the inventory is counted. At the end of January, the amount of parts on hand is $36,100. Hint: What adjustment is needed to reduce the asset account to its proper carrying value? Any expense involved should be included in Maintenance Expense. b. The estimated useful life of the hangar is 20 years with an estimated salvage value of $10,000 at the end of its life. The original cost of the hangar was $250,000. c. The estimated useful life of the aircraft is ten years with an estimated salvage value of $50,000. The original cost of the aircraft was $650,000. d. As tickets are sold in advance, the amounts are added to Cash and to the liability account Tickets Sold in Advance. A count of the redeemed tickets reveals that $47,000 worth of tickets were used during January. e. Wages and salaries owed but unpaid to employees at the end of January total $7,600. f. Northern rents excess hangar space to other companies. The amount owed but unpaid to Northern at the end of January is $2,500. g. Assume a corporate income tax rate of 34%.

Required

1. For each of the preceding items of additional information, identify and analyze the effect of the adjustment. 2. Prepare an income statement for January and a balance sheet at January 31.