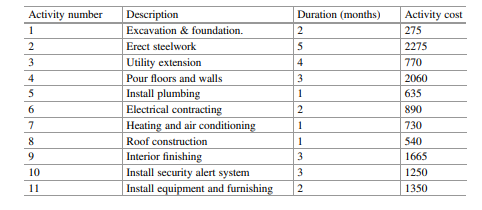

Consider the environment of 9.6. The activity costs are as the ones reported in the table below. The total project cost is $12,440,000. The contractor has come to an agreement with a bank for borrowing funds at an interest rate of 2% per month if needed. The advance payment is $500,000 and there will be 4 more payments by the client at the end of months 4, 8, 12, and 17 where the payments will be the sum of activity costs of all the activities which have been completed since the last payment plus a mark-up of 4%. The contractor incurs the activity costs at the end of the respective activities

(a) Determine the schedule to maximize the NPV of the contractor. Provide the Gantt chart for the resulting schedule. (b) Provide the cash flow profile for the resulting schedule. Calculate the NPV. Use 2% per month as the discount rate. Does the contractor incur any financing charges? Discuss. (c) If the contractor does not want to incur any financing charges, what would be then the maximum amount she has to use from her own resources?