1. Your firm is looking at a proposal to manufacture a certain computer called Comp-I. The

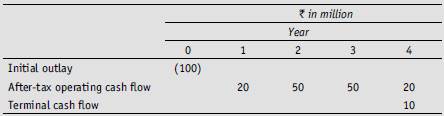

projected cash flows for this proposal are as follows:

The discount rate applicable to this proposal is 20 percent.

If your fi rm undertakes Comp-I proposal, it will be in a position to make a follow on

investment in an advanced version, Comp-II, four years from now. Comp-II will be double

the size of Comp-I in terms of investment outlay and cash infl ows. The cash infl ows of Comp-

II would have a standard deviation of 30 percent per year.

(a) What is the net present value of the cash fl ows of Comp-I?

(b) What is the value of the option to invest in Comp-II?

Assume that the risk-free rate is 12 percent.