1.A Ltd owns 100 000 shares in B Ltd. The current price of B Ltd shares is $4.80. The terms

under which A Ltd acquired the shares in B Ltd means that it will have to wait one month

before it is able to sell the shares in B Ltd. To avoid the effects of market volatility, A Ltd

enters into a futures contract on B Ltd shares in which A Ltd takes a sell position. The price

of a B Ltd future is $4.85 and the futures contract is for 100 000 units.

One month later the price of B Ltd shares has risen to $6.05, and a B Ltd future costs

$6.15. A Ltd closes out the futures contract and sells the shares.

Required

How much does A Ltd ultimately receive from these transactions?

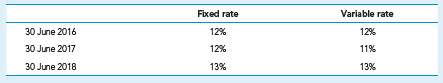

2. Company ZZZ has issued $200 000 of fixed-interest securities for three years at an interest rate of 12% per annum. The company signs an interest rate swap agreement with Bank

AA on 1 July 2016. At the inception of the agreement, the variable rate is 12% per annum.

The relevant market rates of interest during the swap period are as follows:

Required

Prepare the general journal entries to account for this swap agreement. (LO10)