Preparation of a Work Sheet, Financial Statements, and Adjusting and Closing Entries

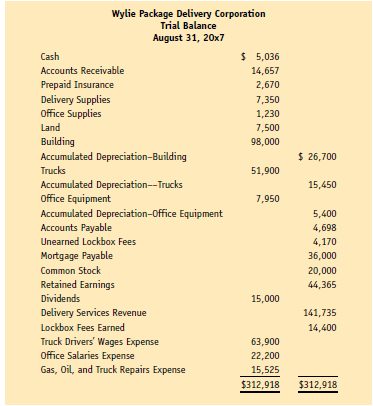

The trial balance on the opposite page was taken from the ledger of Wylie Package Delivery Corporation on August 31, 20×7, the end of the company’s fiscal year.

Required

1. Enter the trial balance amounts in the Trial Balance columns of a work sheet and complete the work sheet using the following information:

a. Expired insurance, $1,530.

b. Inventory of unused delivery supplies, $715.

c. Inventory of unused office supplies, $93.

d. Estimated depreciation, building, $7,200.

e. Estimated depreciation, trucks, $7,725.

f. Estimated depreciation, office equipment, $1,350.

g. The company credits the lockbox fees of customers who pay in advance to the Unearned Lockbox Fees account. Of the amount credited to this account during the year, $2,815 had been earned by August 31.

h. Lockbox fees earned but unrecorded and uncollected at the end of the accounting period, $408.

i. Accrued but unpaid truck drivers’ wages at the end of the year, $960.

j. Management estimates federal income taxes to be $6,000.

2. Prepare an income statement, a statement of retained earnings, and a balance sheet.

3. Prepare adjusting and closing entries.