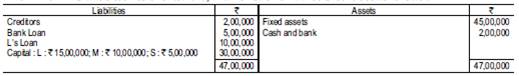

A partnership firm has three partners : X, Y and Z with capitals as X : RS. 20,000; Y : RS. 10,000 and Z RS. 10,000. The creditors amounted to RS. 20,000 and sundry assets to RS. 60,000. In dissolution, the assets were realised as follows: 1st instalment RS. 20,000; 2nd instalment RS. 20,000 and final realisation ~ 10,000. The partners share profits and losses in the ratio of 3 : 2 : 1. Show the piece-meal distribution of the realisations on —- (i) Surplus Capital Method; (ii) Maximum Loss Method. 17. The firm of LMS was dissolved on 31.3.2015, at which date its Balance Sheet stood as follows :

Partners share profits equally. A firm of Chartered Accountants is retained to realise the assets and distribute the cash after discharge of liabilities. Their fees which are to include all expenses is fixed at RS. 1,00,000. No loss is expected on realisation since fixed assets include valuable land and building. Realisations are : Serial Number 1 2 3 4 5

Amount in RS. 3,00,000 15,00,000 15,00,000 30,00,000 30,00,000

The Chartered Accountant firm decided to pay-off the partners in ‘Higher Relative Capital Method’. You are required to prepare a statement showing distribution of cash with necessary workings.