Mr Brown had been trading under the name of BS. On 1st January, 2015 a company, X Limited, was formed with an authorised share capital of Rs. 8,00,000. On the same date the entire business of BS, except investments but including cash was transferred to X Limited.

From the information given below you are required to prepare:

(a) a Profit and Loss Account for BS for the year ended 31st December, 2014 and a balance sheet at that date;

(b) a realisation account showing the transfer of the business of BS at 1st January, 2015;

(c) a capital account of Mr Brown at 1st January, 2015;

(d) a balance sheet of X Limited on the completion of the takeover of the business of BS on 1st January, 2015. (Taxation is to be ignored and workings must be shown).

1. All assets taken over by X Limited were transferred at book values except the following, which were taken over by the company at the following valuations:

Land and buildings at Rs.4,00,000; Plant and machinery at Rs. 1,00,000;

2. Investments were valued at Rs.40,000 and were taken over by Mr Brown at that value.

3. The shares of the new company, X Limited, were of Rs. 10 each and issued at par. Mr Brown received 8,00,000

shares in the new company and gave his wife one of these shares so that she would be a shareholder in X Limited.

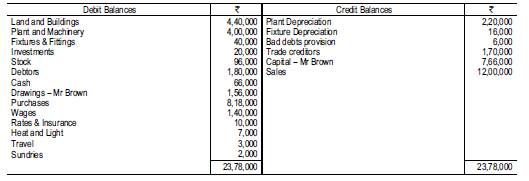

4. The trial balance of BS as at 31st December, 2014 was as follows:

5. The following adjustments were still to be recorded :

(a) Depreciation was to be charged at 5% straight-line on plant and machinery and 10% straight

line on fixtures and fittings;

(b) At the year end a bad debts provision of Rs.20,000 was thought necessary;

(c) Accrued expenses at 31st December, 2014 were:

Wages —- Rs. 5,000; Head and light —- Rs.3,000; Travel —- Rs. 2,000;

(d) Stock at December, 2014 was Rs. 1,14,000.