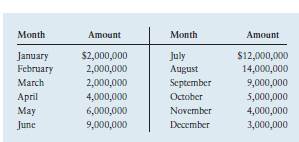

Dynabase Tool has forecast its total funds requirements for the coming year as shown in the following table.

a. Divide the firm’s monthly funds requirement into (1) a permanent component and (2) a seasonal component, and find the monthly average for each of these components.

b. Describe the amount of long-term and short-term financing used to meet the total

funds requirement under (1) an aggressive funding strategy and (2) a conservative

funding strategy. Assume that, under the aggressive strategy, long-term

funds finance permanent needs and short-term funds are used to finance seasonal needs.

c. Assuming that short-term funds cost 5% annually and that the cost of long-term

funds is 10% annually, use the averages found in part a to calculate the total cost

of each of the strategies described in part b. Assume that the firm can earn 3%

on any excess cash balances.

d. Discuss the profitability–risk trade-offs associated with the aggressive strategy and those associated with the conservative strategy.