1.What strategy would the following lead to?

A. (i) Sell one put with high exercise price, E2

(ii) Sell one put with low exercise price, E1

(iii) Buy two puts with medium exercise prices, E0

B. (i) Buy one call with exercise price E4

(ii) Buy one call with exercise price E1

(iii) Sell one call with exercise price E2

(iv) Sell one call with exercise price E3,

(given further that E1 < e2=””>< e3=””><>

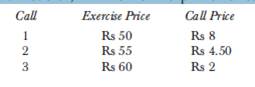

2. The following information is available on call options involving 800 shares each, with two month expiration dates, on a stock:

Explain how these options can be used to create butterfly spreads. Construct a table to show how profit would vary with stock price for the spread and determine the profit or loss when

the price is (i) Rs 67, (ii) Rs 58, (iii) Rs 46, and (iv) Rs 54.

3. How can a butterfly spread be created by using the following three put options (with same expiration dates)?

Option 1 : Exercise price Rs 70 Price = Rs 6

Option 2 : Exercise price Rs 75 Price = Rs 9

Option 3 : Exercise price Rs 80 Price = Rs 14

Determine the range of stock prices within which losses would be made by the buyer of the options.