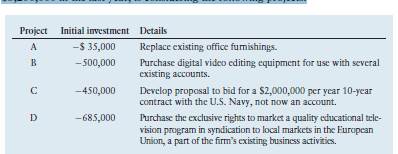

Caradine Corp., a media services firm with net earnings of $3,200,000 in the last year, is considering the following projects.

The media services business is cyclical and highly competitive. The board of directors has asked you, as chief financial officer, to do the following:

a. Evaluate the risk of each proposed project and rank it “low,” “medium,” or

“high.” b. Comment on why you chose each ranking.

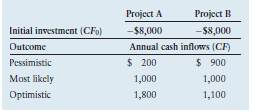

2. Murdock Paints is in the process of evaluating two mutually exclusive additions to its processing capacity. The firm’s financial analysts have developed pessimistic, most likely, and optimistic estimates of the annual cash inflows

a. Determine the range of annual cash inflows for each of the two projects.

b. Assume that the firm’s cost of capital is 10% and that both projects have 20-year lives. Construct a table similar to this one for the NPVs for each project. Include the range of NPVs for each project.

c. Do parts a and b provide consistent views of the two projects? Explain.

d. Which project do you recommend? Why?