Energy investment decisions. a) For the payoff table in Exercise 14, find the investment strategy under the assumption that the probability that the price of oil goes substantially higher is 0.4 and that the probability that it goes substantially lower is 0.2. b) What if those two probabilities are reversed?

Exercise 14

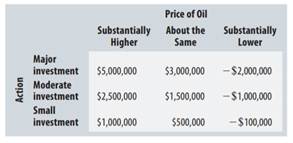

Energy investment. An investment bank is thinking of investing in a start-up alternative energy company. They can become a major investor for $6M, a moderate investor for $3M, or a small investor for $1.5M. The worth of their investment in 12 months will depend on how the price of oil behaves between then and now. A financial analyst produces the following payoff table with the net worth of their investment (predicted worth – initial investment) as the payoff.

Construct a decision tree for this payoff table.