1.(a) Using Black and Scholes formula, calculate the value of a

European call option using the following data:

Exercise Price = Rs 100

Stock Price = Rs 90

Time to expiration = 6 months

Continuously compounded risk-free rate of return = 10% per annum

Variance of continuously compounded rate of return = 0.25

(b) By Put-Call Parity, determine the value of Put option using data in (a) above.

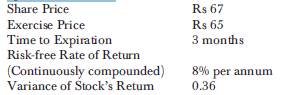

2.. You are given the following data on a certain share and a call

option on the stock:

(i) Calculate the value of the option using the Black and Scholes model.

(ii) If this option is priced at Rs 7.50, what investment strategy would you suggest?

(iii) Use your answer in part (i) to calculate the value of a put option with identical exercise price and time to maturity.