Call on a bond.

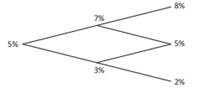

This problem is about the valuation of a call on a bond and goes beyond the scope of equity derivatives. Consider a world where, at any given point in time t, the interest rate curve is flat at rate rt which may vary. Currently, ![]() for all maturities. Below is a tree of various scenarios made by analysts for the evolution of rt over the next two years.

for all maturities. Below is a tree of various scenarios made by analysts for the evolution of rt over the next two years.

(a) Calculate the price of a 5-year zero-coupon bond at each node of the tree. Keep in mind that the maturity of the zero-coupon shortens at each step.

(b) Using a two-step binomial model, calculate the value of a 2-year European call struck at 90 on this bond.