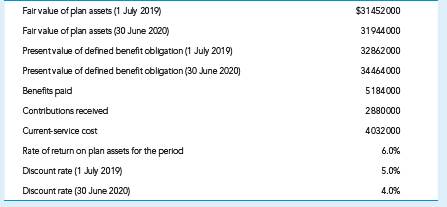

Rizz Ltd contributes to a defined benefit superannuation plan for its employees. The

following information is available for the plan at 30 June 2020.

In July 2019 the plan was amended to increase superannuation benefits for each year of

service starting on 1 July 2015. The present value of the additional superannuation benefits

for service from 1 July 2015 to 1 July 2019 is $2 304 000.

Required

(a) Calculate the net defined benefit liability (asset) recognised in Rizz Ltd’s statement of

financial position as at 30 June 2020.

(b) Calculate the defined benefit cost recognised in Rizz Ltd’s statement of comprehensive

income for the period ended 30 June 2020.

Your answer must comply with the requirements of AASB 119. (LO10)