Central Laundry and Cleaners is considering replacing an existing piece of machinery with a more sophisticated machine. The old machine was purchased 3 years ago at a cost of $50,000, and this amount was being depreciated under MACRS using a 5-year recovery period. The machine has 5 years of usable life remaining. The new machine that is being considered costs

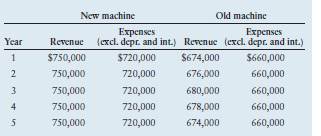

$76,000 and requires $4,000 in installation costs. The new machine would be depreciated under MACRS using a 5-year recovery period. The firm can currently sell the old machine for $55,000 without incurring any removal or cleanup costs. The firm is subject to a tax rate of 40%. The revenues and expenses (excluding depreciation and interest) associated with the new and the old machines for the next 5 years are given in the table below. (See Table 4.2 on page 112 for the applicable depreciation percentages.)

a. Calculate the initial investment associated with replacement of the old machine

by the new one.

b. Determine the incremental operating cash flows associated with the proposed replacement.

(Note: Be sure to consider the depreciation in year 6.)

c. Depict on a time line the relevant cash flows found in parts a and b associated

with the proposed replacement decision.