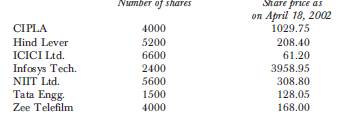

1.Consider the portfolio of Mr Anand given here:

(i) Calculate the beta of his portfolio, using information given

in Box 3.6. (ii) The May futures on BSE Sensex are quoted at 3444.60.

Assuming the market lot to be 100, calculate the number of contracts Mr Anand should short for hedging his portfolio against possibly falling markets1. Differentiate between call and put options. What are the rights and obligations of the holders of long and short positions in

them?