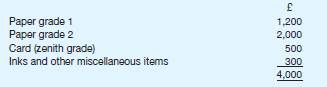

Based on historic cost, direct material cost was computed as follows:

Paper grade 1 is regularly used by the business. Enough of this paper to complete the job is currently

held. Because it is imported, it is estimated that if it is used for this job, a new purchase

order will have to be placed shortly. Sterling has depreciated against the foreign currency by

25 per cent since the last purchase.

Paper grade 2 is purchased from the same source as grade 1. The business holds exactly

enough of it for the job, but this was bought in for a special order. This order was cancelled,

although the defaulting customer was required to pay £500 towards the cost of the paper. The

accountant has offset this against the original cost to arrive at the figure of £2,000 shown above.

This paper is rarely used, and due to its special chemical coating will be unusable if it is not used

on the job in question.

The card is another specialist item currently held by the business. There is no use foreseen,

and it would cost £750 to replace if required. However, the inventories controller had planned

to spend £130 on overprinting to use the card as a substitute for other materials costing £640.

Inks and other items are in regular use in the print shop.