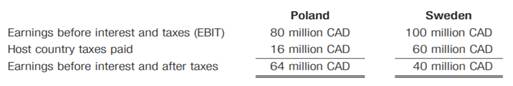

Qu’Appelle Enterprises, a Canadian real-estate investment firm, is considering its international tax situation. Canadian tax law requires Canadian corporations to pay taxes on their foreign passive income at the same rate as profits earned in Canada; this rate is currently 35%. However, a full tax credit is given for the foreign taxes paid up to the amount of the Canadian tax liability. Qu’Appelle has major operations in Poland, where the tax rate is 20%, and in Sweden, where the tax rate is 60%. The profits, which are fully and immediately repatriated and foreign taxes paid for the current year are shown here:

a. What is the Canadian tax liability on the earnings from the Polish subsidiary assuming the Swedish subsidiary did not exist?

b. What is the Canadian tax liability on the earnings from the Swedish subsidiary assuming the Polish subsidiary did not exist?

c. Under Canadian tax law, Qu’Appelle is able to pool the earnings from its operations in Poland and Sweden when computing its Canadian tax liability on foreign earnings. Total EBIT is thus 180 million CAD, and the total host country taxes paid is $76 million CAD. What is the total Canadian tax liability on foreign earnings? Show how this relates to the answers in parts (a) and (b).