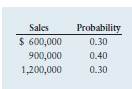

Country Textiles, which has fixed operating costs of $300,000 and variable operating costs equal to 40% of sales, has made the following three sales estimates, with their probabilities noted.

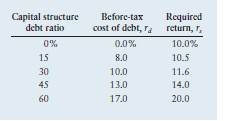

The firm wishes to analyze five possible capital structures: 0%, 15%, 30%, 45%,

and 60% debt ratios. The firm’s total assets of $1 million are assumed to be constant.

Its common stock has a book value of $25 per share, and the firm is in the 40% tax bracket. The following additional data have been gathered for use in analyzing the five capital structures under consideration.

a. Calculate the level of EBIT associated with each of the three levels of sales.

b. Calculate the amount of debt, the amount of equity, and the number of

shares of common stock outstanding for each of the five capital structures being

considered.

c. Calculate the annual interest on the debt under each of the five capital structures

being considered. (Note: The before-tax cost of debt, rd, is the interest rate applicable

to all debt associated with the corresponding debt ratio.)

d. Calculate the EPS associated with each of the three levels of EBIT calculated in

part a for each of the five capital structures being considered.

e. Calculate (1) the expected EPS, (2) the standard deviation of EPS, and (3) the coefficient

of variation of EPS for each of the five capital structures, using your

findings in part d.

f. Plot the expected EPS and coefficient of variation of EPS against the capital

structures (x axis) on separate sets of axes, and comment on the return and risk

relative to capital structure.

g. Using the EBIT–EPS data developed in part d, plot the 0%, 30%, and 60% capital

structures on the same set of EBIT–EPS axes, and discuss the ranges over

which each is preferred. What is the major problem with the use of this approach?

h. Using the valuation model given in Equation 12.12 and your findings in part e,

estimate the share value for each of the capital structures being considered.

i. Compare and contrast your findings in parts f and h. Which structure is preferred

if the goal is to maximize EPS? Which structure is preferred if the goal is

to maximize share value? Which capital structure do you recommend? Explain.