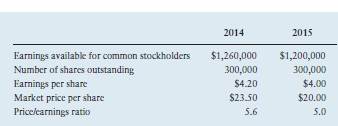

Harte Textiles, Inc., a maker of custom upholstery fabrics, is concerned

about preserving the wealth of its stockholders during a cyclic downturn in

the home furnishings business. The company has maintained a constant dividend

payout of $2.00 tied to a target payout ratio of 40%. Management is preparing a

share repurchase recommendation to present to the firm’s board of directors. The

data at the top of the following page have been gathered from the last 2 years.

a. How many shares should the company have outstanding in 2015 if its earnings

available for common stockholders in that year are $1,200,000 and it pays a dividend

of $2.00, given that its desired payout ratio is 40%?

b. How many shares would Harte have to repurchase to have the level of shares

outstanding calculated in part a?