Determining Adjusting Entries, Posting to T Accounts, and Preparing an Adjusted Trial Balance

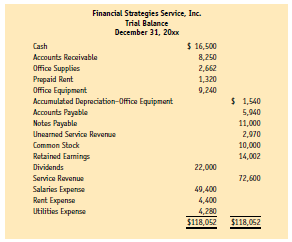

The trial balance for Financial Strategies Service, Inc., on December 31 is presented on the following page.

The following information is also available:

a. Ending inventory of office supplies, $264.

b. Prepaid rent expired, $440.

c. Depreciation of office equipment for the period, $660.

d. Accrued interest expense at the end of the period, $550.

e. Accrued salaries at the end of the period, $330.

f. Service revenue still unearned at the end of the period, $1,166.

g. Service revenue earned but unrecorded, $2,200.

h. Estimated income taxes for the period, $4,000.

Required

1. Open T accounts for the accounts in the trial balance plus the following:

Interest Payable; Salaries Payable; Income Taxes Payable; Office Supplies

Expense; Depreciation Expense–Office Equipment; Interest Expense; and

Income Taxes Expense. Enter the balances shown on the trial balance.

2. Determine the adjusting entries and post them directly to the T accounts.

3. Prepare an adjusted trial balance.

4. User insight: What financial statements do each of the above adjustments affect? What financial statement is not affected