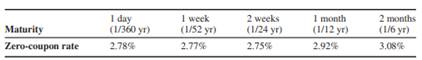

Zero-coupon rate curve and expectations. The short-term zero-coupon rate curve of the euro zone is given as:

The current refinancing rate of the European Central Bank (ECB) is at 2.75%. This is the rate at which banks can borrow from the ECB for 2 weeks. The ECB Board of Governors will meet in 2 weeks and potentially decide on a new refinancing rate R.

(a) Without making any calculation can you guess if the market expects the ECB to:

(i) Lower its rate by 25 bps (i.e. R = 2.5%)?

(ii) Leave its rate unchanged (i.e. R = 2.75%)?

(iii) Raise its rate by 25 bps (i.e. R = 3%)?

(iv) Raise its rate by 50 bps (i.e. R = 3.25%)?

(v) Any other scenario?

(b) The treasury department at Lezard Brothers, a reputed investment bank, must find €100mn in cash for the coming month. Find two ways to achieve this objective. What are the corresponding borrowing costs?

(c) Does your answer to question (b) support or invalidate your answer to question (a)?

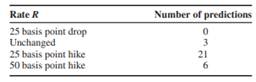

(d) Fadeberg News, a financial news agency, recently published the following survey of the predictions from leading financial economists at top investment banks:

Based on this survey, Bernard Bull, a trader at Lezard Brothers, thinks that the 1-month zerocoupon rate of 2.92% is overvalued and comes to you, the head of trading at Lezard Brothers, with the following strategy:

• Invest €100mn at 2.92% over one month;

• Borrow €100mn at 2.75% for 2 weeks;

• In 2 weeks, roll over and borrow €100mn at rate R for 2 weeks.

(i) Bernard says his strategy is a “fantastic arbitrage opportunity.” Do you agree?

(ii) Calculate the profit or loss of this strategy in each of the scenarios in the survey.

(iii) Do you give a thumbs up to Bernard? There is no unique answer to this question.