Option payoffs. The three questions are independent.

(a) In each of the three examples in identify the underlying assets, the maturity date, and the payoff formula.

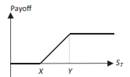

(b) Find a portfolio of European options on an underlying asset S with maturity T whose payoff matches the figure below:

(c) What is the payoff at maturity of a portfolio long a zero-coupon bond with face value $90 and an in-the-money European call option struck at $90 on an underlying stock S currently trading at $100? Assuming no dividends, no arbitrage, infinite liquidity, and the ability to short-sell, show that this portfolio must be worth more than $100.