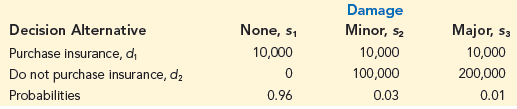

Alexander Industries is considering purchasing an insurance policy for its new office building in St. Louis, Missouri. The policy has an annual cost of $10,000. If Alexander Industries doesn’t purchase the insurance and minor fire damage occurs, a cost of $100,000 is anticipated; the cost if major or total destruction occurs is $200,000. The costs, including the state-of-nature probabilities, are as follows:

a. Using the expected value approach, what decision do you recommend?

b. What lottery would you use to assess utilities? (Note: Because the data are costs, the best payoff is $0.)

c. Assume that you found the following indifference probabilities for the lottery defined in part (b). What decision would you recommend?