A Head Office in Calcutta has a branch at Haldia. All purchases are made by Head Office and goods sent to the branch are invoiced at cost plus 25%. All cash received by branch is deposited to the Head Office Account in the branch of the Head Office’s bank.

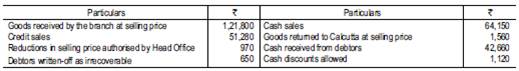

The branch maintains a Sales Ledger and other necessary subsidiary books; but all other branch transactions are recorded in the Head Office books.The following information pertaining to the branch has been collected for the year ended December 31, 2014:

In the Head Office books, prepare the Branch Stock Account, Branch Debtors Account and Branch Profit and Loss Account.

Q356;B.S. Ltd. operates a retail branch at Ranchi. All purchases are made by the Head Office in Calcutta. Goods for the branch being delivered to it direct and charge out at selling price, which is cost price plus 50 per cent. All cash received by the branch is remitted to Calcutta. Branch expenses are paid by the branch out of an imprest account which is reimbursed by Calcutta monthly. The branch keeps a Sales Ledger and certain essential subsidiary books; but otherwise all branch transactions are recorded in the books of the Calcutta office. On January 1, 2014, Stock-in-trade at the branch at selling price, amounted to ~ 48,660 and Debtors to ~ 6,440. During the year ended December 31,2014, the following transactions took place at the branch:

A consignment of goods despatched to the branch in December, 2014, at a selling price of ~ 1,200 was not received by the branch until January 6, 2015 and had not been included in its stock figure. The expenses relating to the branch for the year ended December 31, 2014 amounted to ~ 17,290. On December 31, 2014, Physical stock at the branch, at selling price amounted to ~ 52,200. You are required to write-up the Branch Stock Account and the Branch Total Debtors Account maintained in Calcutta books, and to prepare the Trading and Profit and Loss Account of the branch for the year ended December 31, 2014.