Corporate Income Tax Rate Schedule

E 6. Using the corporate tax rate schedule in Table 1, compute the income tax liability for the following situations:

Situation Taxable Income

A $ 70,000

B 85,000

C 320,000

Income Tax Allocation

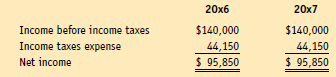

The Danner Corporation reported the following accounting income before income taxes, income taxes expense, and net income for 20×6 and 20×7:

On the balance sheet, deferred income taxes liability increased by $19,200 in 20×6 and decreased by $9,400 in 20×7.

1. How much did Danner actually pay in income taxes for 20×6 and 20×7?

2. Prepare entries in journal form to record income taxes expense for 20×6 and 20×7.