Analysis of Alternative Financing Methods

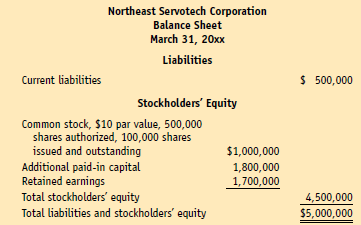

Northeast Servotech Corporation, which offers services to the computer industry, has expanded rapidly in recent years. Because of its profitability, the company has been able to grow without obtaining external financing. This fact is reflected in its current balance sheet, which contains no long-term debt. The liabilities and stockholders’ equity sections of the balance sheet on March 31, 20xx, appear below.

The company now has the opportunity to double its size by purchasing the operations of a rival company for $4,000,000. If the purchase goes through, Northeast Servotech will become one of the top companies in its specialized industry. The problem for management is how to finance the purchase. After much study and discussion with bankers and underwriters, management has prepared the following three financing alternatives to present to the board of directors, which must authorize the purchase and the financing:

Alternative A The company could issue $4,000,000 of long-term debt. Given the company’s financial rating and the current market rates, management believes the company will have to pay an interest rate of 12 percent

on the debt. Alternative B The company could issue 40,000 shares of 8 percent, $100 par value preferred stock. Alternative C The company could issue 100,000 additional shares of $10 par value common stock at $40 per share.

Management explains to the board that the interest on the long-term debt is tax-deductible and that the applicable income tax rate is 40 percent. The board members know that a dividend of $.80 per share of common stock was paid last year, up from $.60 and $.40 per share in the two years before that. The board has had a policy of regular increases in dividends of $.20 per share. The board believes each of the three financing alternatives is feasible and now wants to study the financial effects of each alternative.

1. Prepare a schedule to show how the liabilities and stockholders’ equity sections of Northeast Servotech’s balance sheet would look under each alternative, and compute the debt to equity ratio (total liabilities _ total stockholders’ equity) for each.

2. Compute and compare the cash needed to pay the interest or dividends for each kind of new financing, net of income taxes, in the first year.

3. How might the cash needed to pay for the financing change in future years under each alternative?

4. Prepare a memorandum to the board of directors that evaluates the alternatives in order of preference based on cash flow effects, giving arguments for and against each one.