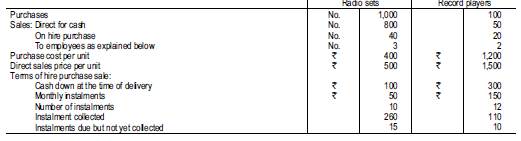

Majestic & Co. commenced business on January 1, 2014 dealing in radio sets and record players. They sell goods both directly as well as on hire purchase. You are furnished with the following information for the year ended 31st December, 2014:

During the year the firm repossessed 3 radio sets and 2 record players for failure to pay the instalments. The hire purchase customers had paid only 4 instalments each in respect of these radio sets and record players. At the time of repossession, the radio sets were valued at Rs. 200 each and the record players were valued at Rs. 500 each. The firm spent Rs.30 per radio set and Rs. 70 per record player on reconditioning. These sets were sold to employees at a concessional rate of Rs.300 per radio set and Rs. 700 per record player and the amount was recovered from their salaries before the close of the year. You are required to prepare columnar :

(i) Hire Purchase Trading Account; (ii) Goods sold on Hire Purchase Account; (iii) Purchases Account; (iv) Goods Repossessed Account; and (iv) General Trading Profit and Loss Account.