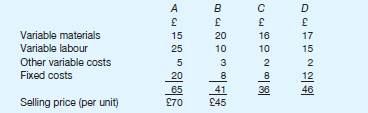

Intermediate Products Ltd produces four types of water pump. Two of these (A and B) are sold by the business. The other two (C and D) are incorporated, as components, into another of the business’s products. Neither C nor D is incorporated into A or B. Costings (per unit) for the products are as follows:

There is an outside supplier who is prepared to supply unlimited quantities of products C and D

to the business, charging £40 per unit for product C and £55 per unit for product D. Next year’s estimated demand for the products, from the market (in the case of A and B) and from other production requirements (in the case of C and D), is as follows:

For strategic reasons, the business wishes to supply a minimum of 50 per cent of the above

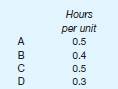

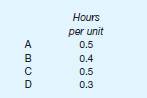

demand for products A and B. Manufacture of all four products requires the use of a special machine. The products require time on this machine as follows:

Next year there are expected to be a maximum of 6,000 special-machine hours available. There

will be no shortage of any other factor of production.

Required:

(a) State, with supporting workings and assumptions, which quantities of which products the

business should plan to make next year.

(b) Explain the maximum amount that it would be worth the business paying per hour to rent a

second special machine.

(c) Suggest ways, other than renting an additional special machine, that could solve the problem

of the shortage of special-machine time.